By Jenny Adair

In this piece we examine the link between the length of time countries across the world have spent in lockdown and the economic damage. Are lockdowns completely to blame for the contraction of GDP around the globe?

In times of crisis, the economy is usually the first port of call for disaster—and the impact can be felt for many years after. The Bank of England says that history has proven there are two certain things when it comes to financial crises: another one will follow, and it will be different from the last one.

Our world has changed dramatically over the best part of a year. A rare disaster of a global pandemic never before seen in our lifetime has resulted in countries introducing necessary quarantines and social distancing measures in a bid to curb the spread of the virus. This has had a negative but necessary effect on our economies. A crisis bringing great uncertainty, governments are providing support to workers, businesses, and financial markets to guide us towards a strong recovery. However, there is doubt about what our global economic landscape will look like when things return to normal.

Lockdown across the world

Policymakers have had the difficult decision of when to implement lockdown, the severity of restrictions, and how long to keep measures in place for. Lockdown restrictions have been met with both open arms and criticism in places all over the world. For example, in South Africa, the strictest measures were put in place to combat some of the highest levels of the virus. The country banned the sale of alcohol and tobacco.

Although saving lives, there are devastating effects for global economies, with spending plummeting to all-time lows. Research by financial firm Jefferies in the United States has shown that in states such as Arizona, Texas, and Utah, where the number of COVID-19 cases was rising dramatically, spending starts to contract. When comparing state data on Google which looks into retail and recreation establishments, states with high numbers of the virus are performing considerably worse than others.

Denmark and Sweden approached lockdown quite differently, with Sweden choosing to trust its people to behave responsibly rather than enforce a lockdown. Meanwhile, Denmark introduced one of the earliest and strictest lockdowns. Although Sweden’s death rate was five times higher than Denmark’s, the economic impact was similar.

The reason for that, Dhaval Joshi, of BCA research says, is that people change their behaviour whether there is a lockdown or not. They avoid public transport, stay away from shops, and refuse to send their children to school. Joshi argued that this is because people change their behaviour whether there is a lockdown or not, avoiding public transport, staying home where possible, and refusing to send their children to school.

Here, we take a look at how long countries were in lockdown for to see if there is a link between economic damage and lockdowns.

Global GDP change

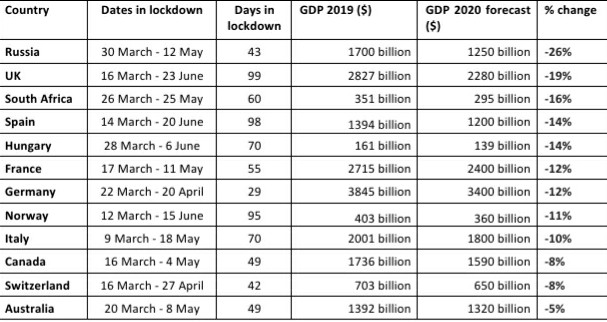

QuickBooks, online accounting software firm, conducted research looking at dates where lockdown was first introduced in a country and ending on the date they were gradually lifted. 2019’s GDP for each country and 2020 forecast figures from Trading Economics were explored.

The countries explored in this data that have experienced the highest contraction of GDP are:

1. Russia (-26%)

2. UK (-19%)

3. South Africa (-16%)

4. Spain (-14%)

5. Hungary (-14%)

The countries explored in this data that have experienced the lowest contraction of GDP are:

1. Australia (-5%)

2. Switzerland (-8%)

3. Canada (-8%)

4. Italy (-10%)

5. Norway (-11%)

From the data, only two of these countries featured in the top five for lockdown length too. The UK experienced the longest lockdown at 95 days and Spain second with 98 days.

Three of the five countries that have spent the least amount of time in lockdown have experienced the lowest contraction in GDP. Switzerland experienced 42 days in lockdown, and Australia and Canada experienced 49 days.

*The United States did not enter an overall nationwide lockdown, rather, each state had its own lockdown.

Is it worth it?

It seems from the data that there isn’t a pattern reflecting the idea that more days in lockdown has a stronger negative effect on GDP. Despite having locked down for 28 days longer, Spain and Hungary are both projected to take a -14% hit to their overall GDP, for example. Similarly, despite France locking down for 26 more days, both it and Germany are expected to see a -12% drop to their GDP in 2020.

It is possible that there are other contributing factors then, including what was demonstrated and discussed previously with Sweden and Denmark. Regardless of the length of time, it doesn’t seem like a long lockdown has impacted GDP more in comparison to a short lockdown. It is possible that people’s overall behaviours have more of an influence, with populations behaving differently in a pandemic regardless of a lockdown. Research by McKinsey reported that while the uncertainty from COVID-19 continues, its impact is felt differently across different countries. There is a significant difference in how consumers are responding to the crisis and adapt to the next normal, and in turn, having an impact on the economy.

The United States was unique in that they didn’t introduce a nationwide lockdown, and instead allowed states to set their own rules. For example, California was the first state to order lockdown on March 20. Looking at 2020’s forecast, their GDP is set to grow—did smaller, state-wide lockdown based on regional numbers help?

We’re currently in the second wave of the virus, with many countries undergoing a second lockdown. A second lockdown could have further unprecedented negative effects, especially in economies that have already been struggling such as Spain and South Africa.

Is it possible that lockdowns themselves aren’t always to blame for the falling GDP? While lockdown is necessary to save lives, it has been a controversial topic globally. Utilising lockdowns wisely and effectively is integral to protect both lives and countries, but it’s important we understand the impact socially and financially.